WE BUY HOUSES IN OKLAHOMA CITY

SELLING YOUR HOUSE THE EASY WAY 100% HASSLE FREE!

No Realtors, No Fees, No Repairs, Just CASH!

Welcome To Our Blog!

Selling, Buying, or Just Fact Finding about Real Estate Investing?

Here is where we try to answer all your questions about real estate investing, selling your home for cash, and any other question regarding real estate you might have! We love to hear from potential buyers, sellers, innovators, or just people looking into real estate investing as a whole. Please feel free to reach out with any questions or comment on any of our blogs. We look forward to chatting!

Selling a Vacant House in Oklahoma? How to Protect Your Real Estate Investment Before It Costs You

Own a vacant house in Oklahoma? Learn how vacant real estate can drain your finances and how to sell your empty property fast without repairs or listing delays. ...more

Real Estate Tips ,Home Buyer For Cash &Sell Your House Fast

March 04, 2026•3 min read

Behind on Property Taxes in Oklahoma? How to Sell Your House Before Tax Foreclosure

Behind on property taxes in Oklahoma? Learn how tax delinquency affects real estate ownership and how to sell your house fast before foreclosure or tax auction. ...more

Real Estate Tips ,Home Buyer For Cash &Sell Your House Fast

March 01, 2026•3 min read

Selling a House With Code Violations in Oklahoma: What Homeowners Need to Know

Have city code violations on your Oklahoma property? Learn how code issues affect real estate sales and how to sell your house fast without making costly repairs. ...more

Real Estate Tips ,Home Buyer For Cash &Sell Your House Fast

February 27, 2026•3 min read

Selling a Vacant House in Oklahoma? Why Empty Homes Cost You More Every Month

Own a vacant house in Oklahoma? Learn the hidden costs of holding an empty property and how selling your vacant home fast can save you thousands. ...more

Real Estate Tips ,Home Buyer For Cash &Sell Your House Fast

February 24, 2026•4 min read

Tired of Bad Tenants? Sell Your Rental Property Fast Without Evictions

Dealing with problem tenants? Learn how to sell your rental property fast without waiting for evictions or making repairs. ...more

Real Estate Tips ,Home Buyer For Cash &Sell Your House Fast

February 20, 2026•2 min read

Owe Back Property Taxes? How to Sell Your House Fast Before It’s Too Late

Behind on property taxes? Discover how to sell your house fast for cash and avoid tax liens or tax foreclosure. ...more

Real Estate Tips ,Home Buyer For Cash &Sell Your House Fast

February 17, 2026•2 min read

Have You Ever Watched HGTV?

Do You Think Your House Belongs on "Unsellable Houses?"

If a Realtor has given you a TO DO list a mile long and you just don't have the energy or time.... that is OK! We are a great alternative to listing your home with a Realtor because we will take it AS-IS!!!

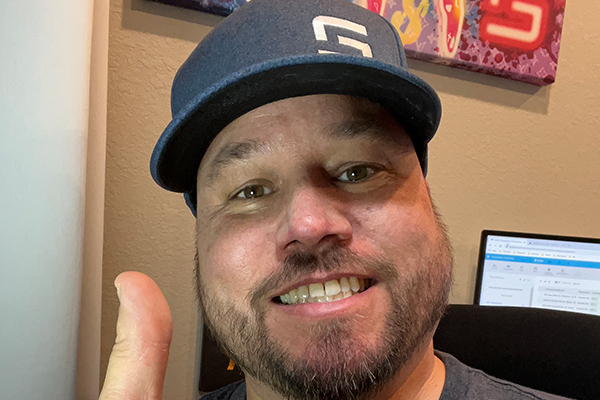

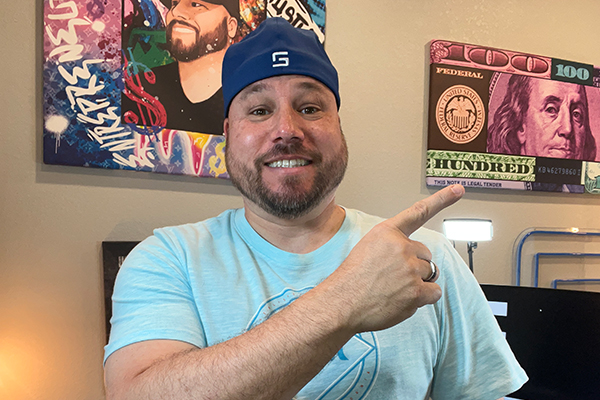

We at Home Buyer For Cash have a passion for solving problems. After years of connecting buyers and sellers through advertising, our founder Graylan Stewart decided it was time to try something new. In 2011 he founded Home Buyer For Cash. Over the last 11 years our team has learned a lot about the real estate industry and developed a true passion for helping sellers solve their real estate woes.

So often even the idea of selling a property can be overwhelming....

You can trust that we have helped sellers in a variety of situations. From pre-foreclosure to missing heirs... From hoarder homes to tenants from hell... we can help! Call 405-449-2274 We Are Here To Help!

Ready to turn that house into CASH?

405-449-2274

Home Buyer For Cash LLC is a company that purchases, rehabs, and then sells houses at a profit. Offers are made to sellers based on market value and repairs needed. Home Buyer For Cash will do everything possible to bring forth the highest possible offer while at the same time giving seller the benefit of a fast sale with no repairs, cleaning, or work on their part.

© 2024

Home Buyer For Cash. All Rights Reserved. |www.homebuyerforcash.com| 405-449-2274 | [email protected] | Terms & Conditions | Privacy Policy

Ready to turn that house into CASH?

Facebook

Instagram

X

LinkedIn

Youtube

Google Plus